Chargeback Alerts

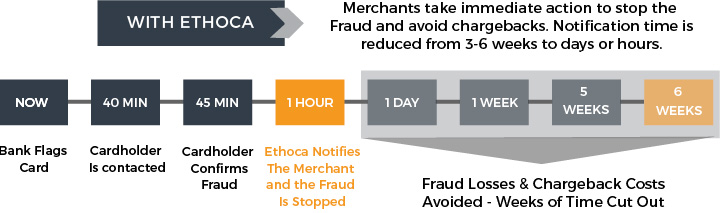

As an online merchant, your fraud discovery and chargeback management process prevents you from taking immediate action to stop fraud loss and avoid costly chargeback fees. By the time you’re notified, up to five weeks have elapsed. You’ve long since missed your opportunity to take action. With Ethoca’s direct access to cardholder-confirmed fraud intelligence, you now have the time and insight to make a difference.

CAP® service powered by Ethoca® gives merchants the flexibility they need to manage chargebacks efficiently and effectively. Merchants can choose between GRAYPAY’s two convenient service options CAP® Standard or CAP® Premier.

Benefits Include:

- Take action to stop the fulfillment of fraudulent orders

- Eliminate more chargebacks and control charge back ratios

- Isueing more refunds promotes higher issuer acceptance and

improves the customer experience - Bolster fraud screening to identify future fraud and prevent spikes

- Use link analysis to eliminate related fraudulent orders

[one_half padding=”0 5px 0 0″]

Standard:

GRAYPAY CAP Standard empowers your company with access to unparalled tools and resources that effectively manage your fraud and chargeback process.

ANY WAY YOU WANT!

- Fast and easy access to alerts through Web Portal.

- Receive batch files of your alerts to work with your own fraud review systems.

- Integrate with GRAYPAY API to automate the alerts review process.

[/one_half]

[one_half_last padding=”0 0 0 5px”]

Premier:

GRAYPAY CAP Premier places your company’s chargeback process under the management of a dedicated GRAYPAY account specialist.

HOW IT WORKS

Your dedicated GRAYPAY account specialist actively monitors your processing account to identify, mediate, reconcile, and process all chargeback issues on your behalf!

[/one_half_last]